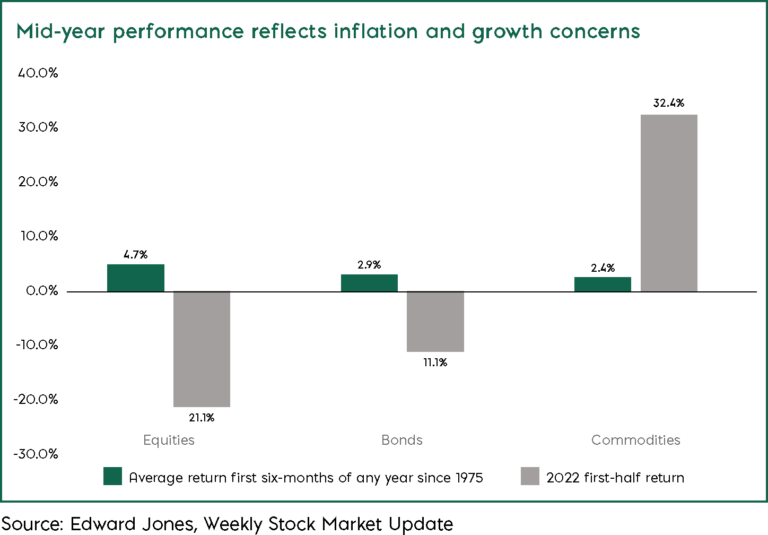

The first half of 2022 has been exceptional, but for all the wrong reasons. This has been the worst first six months of a year for equities since 1975. It is rare for both equities and bonds to fall during the same quarter. This year they have both fallen in two consecutive quarters – something we have not seen since the Great Financial Crisis in 2008. On the other hand, commodity prices have risen sharply.

In this update we will consider the factors that have driven these market moves, discuss the outlook and highlight where we have been identifying opportunities.

What is driving market volatility?

Three main factors have driven market volatility: supply chain disruption, the war in Ukraine and central banks raising interest rates. Supply chain disruption began last year, as logistics networks struggled to keep pace with the surge in demand as nations emerged from COVID lockdowns. This was largely due to labour shortages, after workers laid off during the pandemic found work elsewhere. This rippled through various sectors, disrupting everything from seaports to airports.

At the start of this year, central bankers and investors were expecting supply chain disruption to ease, resulting in an easing of inflation. Interest rates were expected to rise, but at a very gradual pace to avoid hampering economic growth.

Then Russia invaded Ukraine, further disrupting supply chains and sending the price of oil, gas and many other commodities surging. This has in turn led to inflation remaining higher for longer. We can see the impact of rising inflation in many areas of everyday life, from food prices to petrol costs. Some of the industries where it is most pronounced are those looking to recoup lost revenue from the pandemic, such as the travel and leisure sector. As a result of this steep increase in inflation, central banks have had no option but to tackle it by raising interest rates aggressively. This has been the most significant driver of market volatility, because higher interest rates have implications for companies’ financing costs.

Markets have fallen as investors factor in the impact of higher costs on companies’ profits. In short, they are willing to pay less for companies in a higher interest rate environment.

Outlook

Looking ahead, we expect the narrative to shift from worries about inflation to concerns about recession. Central banks are doing the right thing by raising interest rates. This will increase costs for consumers and businesses, which should help to bring down inflation, as we all rein in our spending.

Inflation is already showing signs of weakening and most commodities have fallen from their highs. This is because demand is slowing due to reduced spending. The question now is whether we will all stop spending to the extent that we create a recession.

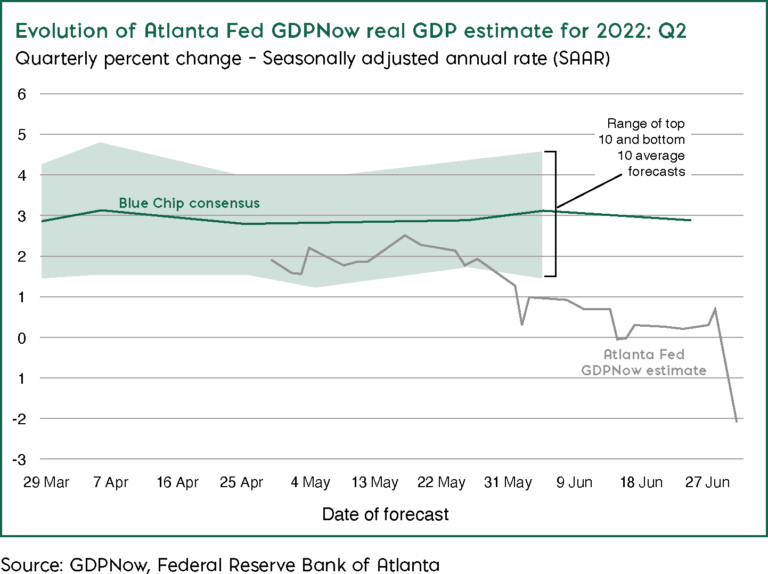

The Atlanta Fed GDPNow model, which has a strong forecasting track record, predicts a decline of just over 2% in US economic output in the second quarter. If that proves correct, the US economy will be in a technical recession.

The slowdown in growth is likely to have an impact on company earnings, which we would expect to fall in the second half of the year. With companies contending with higher costs, analysts are already revising downwards their forecasts for company profits for the coming quarters.

A slowdown in the housing market, which is the most interest-rate-sensitive segment of the economy, has already begun, with interest rates in developed economies set to climb rapidly, according to Goldman Sachs research.

Mortgage rates have already spiked sharply since last summer in the UK, Canada, New Zealand and the US – and borrowing costs for home-buyers are likely to rise even further. Home sales are down by 40% from their pandemic peak in the US and by half in the UK. While house prices are still rising in the US, Germany and the UK, they are already declining across Australia, Canada and Sweden. In New Zealand, house prices are now 8% down from their pandemic peak.

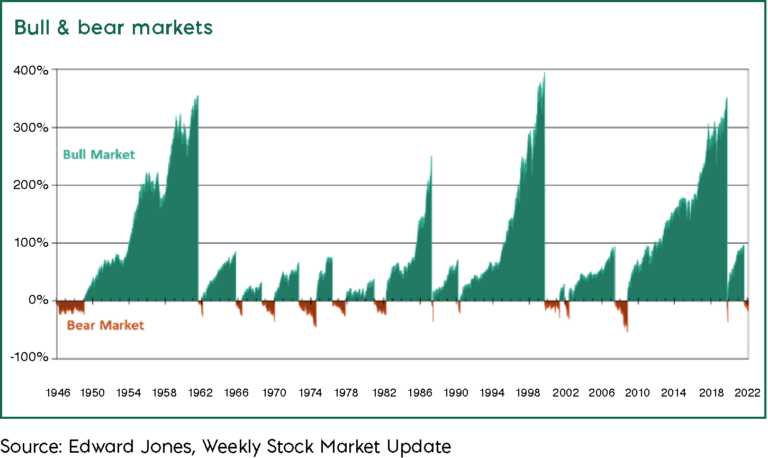

On a more positive note, it is important to remember that equity markets have already moved to factor in events six months ahead, which is why a recession is already priced into valuations.

History shows that over time, bear markets have led to bull markets, which tend to be longer and stronger than the downturns. Since 1950, the average bear market has returned -34% and lasted about 13 months, while the average bull market has returned +167% and lasted nearly four years, according to US company Edward Jones. It is important to remember that economic downturns are a natural part of the business cycle. Over time, however, innovation and productivity improvements tend to drive corporate earnings and market returns higher. While bear markets are uncomfortable, they offer an opportunity for long-term investors.

In our view, the key thing to watch for is central bankers becoming more concerned about recession than inflation. This will signal a slowing of the rate rising cycle, which we would expect to be greeted positively by markets.

Portfolio positioning

We reduced our exposure to small caps earlier this year because of concerns about the impact of rising interest rates. At the same time, we increased our exposure to flexible core funds and quality defensive income funds.

We are overweight UK equities, which were cheap compared with other markets at the beginning of the year. In addition, the UK tends to perform well, in relative terms, during periods of market uncertainty, because of its greater exposure to defensive income-paying companies.

More recently, we have added back to government bonds, which tend to perform better in a recessionary environment. But we remain underweight corporate bonds, which are likely to perform less well in a downturn.

Over and above this, we have identified a number of attractive opportunities caused by the current market volatility and will be deploying our above-average cash weightings to take advantage.

Nathan Sweeney,

Deputy CIO of Multi-Asset,

04/07/2022

FUND BUYS

Allianz UK Income

The fund’s managers, Simon Gergel and Richard Knight, are experienced and have been building a solid performance track record, including performing at the inflexion point, which started late last year. We like their stock-picking approach and the fact that, while this is an income fund, the managers are happy to invest in companies in the expectation of future dividends, even if none are yet being paid. This gives the fund a little more flexibility.

Jupiter Asian Income

We bought Jupiter Asian Income as part of our tactical move into income funds, which tend to offer better downside protection in uncertain markets. The fund is managed by Jason Pidcock, a highly experienced income investor, and focuses on companies with strong balance sheets.

FUND SELLS

Artemis US Smaller Companies

We sold this fund to reduce our risk exposure. Although we have no concerns about the fund’s manager, the investment style is out of favour and we were concerned about the impact of rising interest rates on small caps. We used the proceeds to buy flexible core and income funds.

MAN GLG Continental European

This is a fund that targets high growth and has historically performed well in rising markets, but offered less protection when markets have fallen. We have no fundamental issues with the fund, but have sold it to reduce our exposure to out-of-favour ‘growth’ equities.

Risk Warnings

Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting funds. Our funds invest for the long-term and may not be appropriate for investors who plan to take money out within five years. Tax treatment depends on individual circumstances and may change in the future.

Regulatory Information

This material is for distribution to professional clients only and should not be distributed to or relied upon by any other persons. It’s provided for general information purposes only and is not personal advice to anyone to invest in any fund or product. The Key Investor Information Documents and the Prospectuses for all funds are available, in English, free of charge and can be obtained directly using the contact details in this document. They can also be downloaded from www.ireland.marlboroughfunds.com. An investor must always read these before investing. Information taken from trade and other sources is believed to be reliable, although we don’t represent this as accurate or complete and it shouldn’t be relied upon as such. Calls may be recorded for training and monitoring purposes.

Issued by IFSL International Limited, authorised by Central Bank of Ireland and incorporated in Ireland as a limited company with company no. 616854.

Directors: Raymond O’Neill (Irish), Brian Farrell (Irish) and Wayne Green (British).

Registered office: IFSL International Limited, 7/8 Mount Street Upper, Dublin 2, Ireland.

Issued by IFSL International Limited, authorised by Central Bank of Ireland and incorporated in Ireland as a limited company with company no. 616854