by Nathan Sweeney, Chief Investment Officer – Marlborough Group

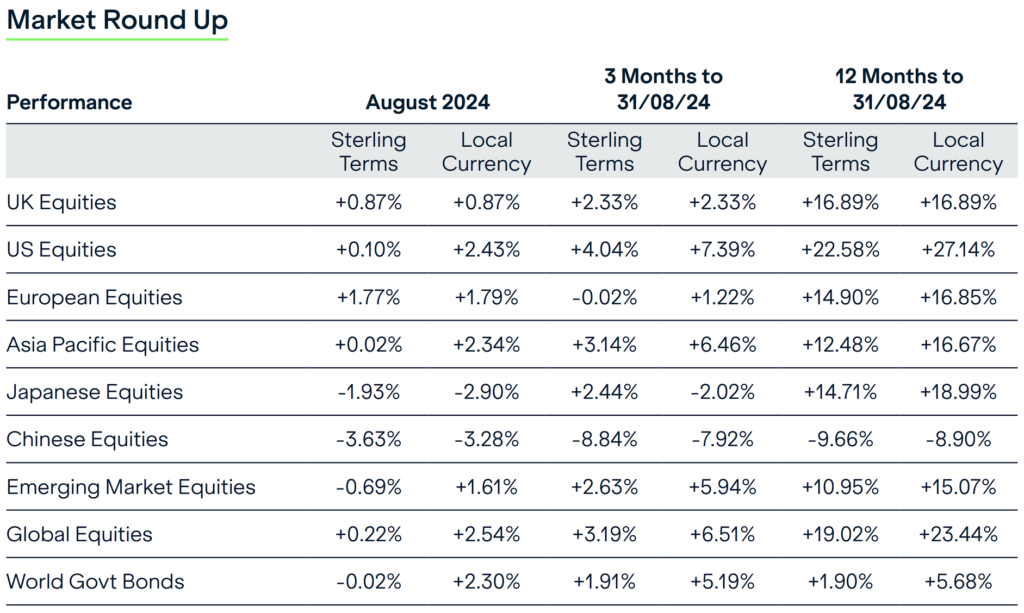

August proved a volatile month for equities, with the Japanese Topix index falling more than 12% in a single day – its largest one-day drop since October 1987. This was caused by the unwinding of the Japanese ‘carry trade’ (please see below for more details). However, the Topix mounted a strong recovery and rebounded by more than 10% in the following day’s trading. Despite this turbulent start to the month, growing expectations that the US Federal Reserve would cut rates in September buoyed markets and by the end of August the S&P 500 had edged into positive territory, if only by the slimmest margin, and UK and European equities were also up.

United Kingdom

The First Cut?

The first cut… After holding interest rates at a 16-year high of 5.25% for a year, the Bank of England (BoE) announced a cut of 0.25% to 5% in August. The decision was a close call with the Monetary Policy Committee voting only 5-4 in favour of the cut. Progress in tackling inflation will be the key driver for monetary policy going forward. Annual inflation has been trending down, despite a slight uptick in August, but services inflation remains elevated.

‘Chipmaker Nvidia’s much-anticipated earnings announcement came towards the end of the month. Whilst both second quarter revenue and third quarter revenue estimates beat expectations, the latter was lower than some had anticipated and this led to a pullback in the share price’

United States

Rate Cut Hopes Bouy Equities

In the US, August began with disappointing economic data and heightened market volatility. Manufacturing and jobs data was much weaker than expected and unemployment increased slightly to 4.3%. However, later in the month, hopes began to grow that the Federal Reserve would begin cutting interest rates in September and this lifted US equity markets, which edged narrowly into positive territory.

Company earnings were generally fairly resilient, though many businesses have commented on reduced spending by consumers. Chipmaker Nvidia’s much-anticipated earnings announcement came towards the end of the month. Whilst both second quarter revenue and third quarter revenue estimates beat expectations, the latter was lower than some had anticipated and this led to a pullback in the share price.

Europe

Signs of a slow improvement Inflation in the Eurozone fell to a three-year low of 2.2% in August, down from 2.6% in July. This was in line with expectations and a step closer to the 2% target of the European Central Bank (ECB). Easing inflation has strengthened the case for another interest rate cut, so all eyes will now be on the September meeting of the ECB. In another positive development, the unemployment rate fell to 6.4% in July.

Japan

Land of the rising rates

As highlighted in our summary section, Japanese equities sold off sharply at the beginning of August after an interest hike by the Bank of Japan (BoJ). This volatility was triggered by the unwinding of the Japanese ‘carry trade’, which involved investors borrowing at ultra-low interest rates in Japan and investing in the US where rates are higher. When Japan increased interest rates at the same time as the US was eyeing a rate cut, hedge funds and other investors rapidly shut down positions worth hundreds of billions of dollars, triggering market volatility.

Core inflation in Japan rose for the third consecutive month in July, when it reached 2.7%. This was up from 2.6% in June and is above the BoJ’s 2% target. Economists believe this rising inflation is due to the effects of the weak yen in the first half of 2024 filtering through to prices.

Asia and Emerging Markets

Some good, some bad

Outflows and China concerns Like most equity markets, stock prices in Asia and Emerging Markets were not immune to the impact of the unwinding of the Japanese ‘carry trade’ at the beginning of August, although most markets subsequently managed to recover ground. Taiwan was the hardest-hit market in Asia, with its tech-heavy index losing almost 13% of its value in the first few days of trading in August, as doubts about the profits likely to be generated by artificial intelligence started to emerge, impacting on semiconductor-related stocks.

Foreign investors have started rotating out of areas in Asia with lofty valuations, with $3.8bn worth of shares in Taiwan, India, South Korea, Vietnam, Thailand and the Philippines being sold over the month. Only India managed to maintain net inflows, with domestic purchases of new issuances offsetting foreign outflows. Investors continue to be concerned about the economic health of China, where authorities have once again intervened, providing liquidity in the financial system to help prop up the ailing property market. In addition, weak corporate earnings from big consumer names such as ecommerce giant PDD Holdings (owner of platform Temu, which operates in the US and Europe, including the UK) have raised alarm bells.

Fixed Income

Some Fears Turning To Cheers

Early August saw a significant miss in US non-farm payroll data that sent shockwaves through bond markets as chatter about recession suddenly re-emerged from the shadows. However, investors had more to cheer about when Federal Reserve minutes showed policymakers were confident they can reduce rates and Fed Chairman Jerome Powell said the time had come to cut, with growing confidence that inflation is falling towards the target rate.

In the UK, decent economic growth data was coupled with more jobs than expected. The BoE has emphasised it will take a gradual approach to further rate cuts, despite a fall in consumer inflation. Sterling rallied during the month and the 10-year gilt yield* ended August close to where it began