by Nathan Sweeney, Chief Investment Officer – Marlborough Group

United Kingdom

Inflation continues to ease

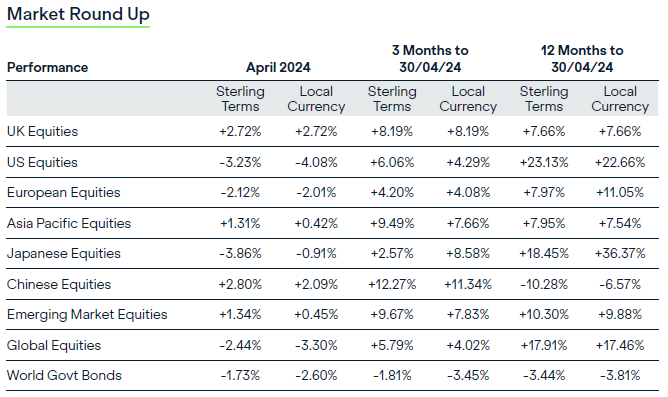

In the UK, inflation continues to trend downward, reaching 3.2% in March, although this was slightly higher than anticipated. Services inflation remained higher at 6%, primarily due to ongoing wage inflation. The British Retail Consortium reported that food price inflation had fallen to 3.4%, the lowest level in two years. April’s UK consumer price index (CPI) inflation rate is expected to ease further towards 2% as typical energy bills drop by just over 12% after regulator Ofgem reduced the energy price cap to its lowest level in two years.

Both consumers and businesses are reacting to the lower inflation environment, as evidenced by consumer confidence hitting a two-year high. Additionally, the UK’s Composite Purchasing Managers’ Index (PMI) survey scored 54, the highest level among G7 countries.

“First quarter earnings results have been positive, and going forward the focus is likely to be on margin management, minimising costs in order to maximise profit.”

United States

Is the economy finally cooling?

Inflation continued to edge higher in the US, rising to 3.5% for the year to March. The Federal Reserve (Fed) may now not begin its cutting cycle until September, when last month the market expected cuts to start in June. Some have suggested the Fed may need to increase interest rates again to combat inflation. However, gross domestic product (GDP) data was lower than expected, showing growth of 1.6% for the first quarter of 2024, against an estimate of 2.4%. This may be

a sign that the world’s largest economy is finally starting to cool, although too much emphasis should not be placed on a single data point.

Broadly, first quarter earnings results have been positive, and going forward the focus is likely to be on margin management, minimising costs in order to maximise profit. Despite this positive sentiment, higher inflation and lower-than-expected GDP growth meant US equities lagged most other regions in April.

Europe

Higher than expected GDP growth

Eurozone GDP grew by 0.3% in the first quarter of 2024, which was above market expectations of 0.1% growth and an improvement on the final quarter of 2023. This was largely due to higher-than-expected economic growth in Germany, France, Italy and Spain. Inflation data continues to support the case for the European Central Bank to cut interest rates in June. Core inflation, which filters out food and energy prices, eased to 2.7% in April. This was slightly above forecasts of 2.6%, but lower than March’s reading of 2.9%, meaning year-on-year core inflation has now been falling since July 2023.

Japan

Investors focus on depreciating Yen

Japanese equities followed a similar downward trend to US and European equities, with the best-performing sector being larger capitalisation value* companies. The focus of investors is now shifting to see if the government steps in to defend the depreciating yen against the US dollar. Recent weakness saw the exchange rate briefly dip to 160 yen to the dollar, with rumours that the Japanese government intervened in the market by buying yen. The exchange rate subsequently corrected back to 155 yen to the dollar. Recent industrial production figures rose by 3.8% (month over month) in March, which was stronger than expected. However, retail sales growth slowed in the same month.

Asia and Emerging Markets

China bounce

Asia and emerging markets (EMs) outperformed developed markets in April, helped by a strong performance by China, which outpaced the wider EM benchmark as investors became more optimistic about the economic outlook. China’s GDP grew by 5.3% in the first three months of this year and a Bloomberg survey of 15 economists put expectations of GDP growth this year at 4.8%. The People’s Bank of China kept its medium-term lending rate on hold. Latin America is still leading the global monetary easing cycle, although Argentina was the only country to cut rates in April.

Fixed Income

Government bond prices fall

Government bond yields** rose significantly in April and investors struggled to find places to hide as the US, Europe and UK all sold off, with bond prices reaching lows for the year. The flurry of data from the US continued to surprise to the positive side, causing a dollar rally against

most other developed market currencies and sweeping sterling to a year-to-date low before it regained some ground by the month end. Meanwhile, all was calm in corporate credit markets, as demand for corporate bonds continued and company earnings were, overall, robust. While investors are still wishing for rate cuts, forecasts have been pushed back and expectations for the number of US cuts have been reduced.